Written by: Carmina Lass, Director of Training and Consulting for Credit Builders Alliance

Written by: Carmina Lass, Director of Training and Consulting for Credit Builders Alliance

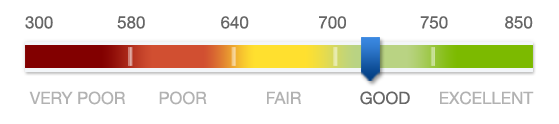

In today’s economy, a good credit history is a financial asset. Distinct from debt – which is a liability defined by what we owe – credit is a measure of our financial health and increasingly influences lenders and others on who they decide to do business with and under what terms and conditions. Having good credit benefits individuals and their families by: creating opportunities to save, improving housing and employment options, buffering economic shocks, improving access to high-quality credit products, and expanding opportunities for asset building.

Unfortunately, for many people with poor credit history (or none at all), it can be difficult to access affordable financial products and services, purchase assistive technology, obtain rental housing and secure opportunities to build wealth through home ownership, pursuit of higher education, and small business ownership.

If you or the people that you work with have ever struggled with credit issues you know that credit and debt management can be overwhelming and confusing at first. However, improving and rebuilding credit history is possible for anyone who is willing to take the first crucial step: create an action plan.

The natural starting place for rebuilding credit is to pull and thoroughly review your free credit report. You can pull your free credit report from each of the three major credit bureaus once per year by visiting www.annualcreditreport.com.

Reviewing the credit report in detail is critical to getting a clear picture of your credit profile, in order to decide the next best steps for improving or rebuilding your credit history. Once you are empowered with the knowledge of what is on your report, you can then create a personal action plan, broken down into bite-sized pieces which may include:

- disputing any errors and inaccuracies that appear on the report;

- getting open delinquent accounts back on track;

- creating a budget and plan to prioritize and pay off outstanding debts, including collection accounts and public records;

- identifying opportunities to establish new positive credit accounts with responsible lenders.

Rebuilding credit history takes time and dedication; make sure to avoid “credit repair” services that make any promises about guaranteed credit score improvement or quick results, or any service that charges upfront fees. Oftentimes these companies charge for services that you can actually do yourself, for free. When in doubt as to how to address complicated credit issues, the best place to turn for help is to an accredited non-profit consumer credit counseling agency or a trusted non-profit organization that provides financial coaching services.

Want to learn more? Join us for a free webinar this Thursday from 10 – 11 AM. Register at http://abilitytools.org/training/training-registration.php